How much do I need to save for retirement?

How "little" is enough for them to save from now on so that their pension is decent and they still have time and energy to enjoy it.

Let's use the example of Tomáš and Marie to show how "little" is enough to save from now on so that their pension is decent and they still have time and energy to enjoy it.Tomas and Marie are now in their thirties and have a two-year-old toddler. Marie is on parental leave and Tomas is working. Both of them set up a retirement savings account at some point and are putting a few hundred into it. They have set up a building society for their son Honzik and put aside 20,000 a year. They live in an apartment they bought with a mortgage and have a few thousand crowns left over each month.

Tomáš and Marie's idea of their joint pension is quite simple. They need 45,000 together to be able to live actively, go to cultural events and travel occasionally. They would like to be able to stop working around the age of 60, at the latest at 65. They don't rely on a state pension and if they get one, it will be on top of that.

Tomas has 23 years to retire. That's still 276 monthly salaries to build up his assets. How much money or what value of investment property is needed to make the annuity payments last for life, i.e. about 25 years?

Thomas and Mary need to build up assets worth at least CZK 9.5 million. This means putting away 15,000 a month for them.

But there is another solution that does not burden the monthly budget so much. If you are interested in how this can be done differently, please get in touch. Let's take a look at your pension plan together.

11/08 2023

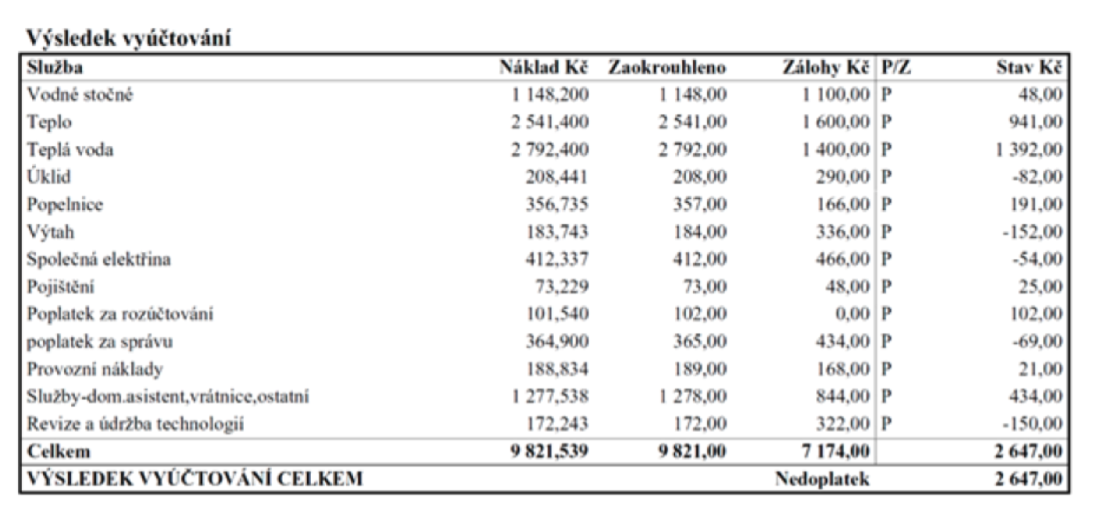

Annual utility billing with the tenants of your apartment.

Do you know what you can have the tenant pay and what you have to pay out of your own pocket?

More