Annual utility billing with the tenants of your apartment.

Do you know what you can have the tenant pay and what you have to pay out of your own pocket?

You have received your annual energy and utility bill for your rented apartment and are considering what can and cannot be charged to your tenants. And how do you even go about settling the bill with the tenants?

By default, in addition to the rent, tenants should pay monthly deposits for services and utilities that they directly consume in the property and from which they immediately benefit.

These items CAN normally be charged to tenants:

- Water and Sewerage | Cold water consumption and disposal of used water to the sewerage system.

- Hot water (formerly DHW) | Hot water consumption.

- Heat | Heating of the dwelling unit.

- Housekeeping | Regular cleaning of common areas in the building.

- External cleaning and winter cleaning of pavements | Maintenance of the house surroundings and snow removal in winter.

- Refuse collection (household solid waste) | Regular balancing of bins.

- Lift (Lift servicing and inspection) | Possibility of using the lift in the house.

- Shared electricity | For example, to power the lift, garage door etc.

- Lighting of the house | Light in the common parts of the house (hallway, cellar, etc.).

- Radio and TV fees | Possibility to use TV and radio in the apartment.

- Inspections (fire safety, lightning conductor, etc.) | Functionality of EZS, EPS systems in the house.

- Reception | Control of the entrance and CCTV system, taking mail and dealing with accidents.

- Garage cleaning, garage door service and repair | Garage parking.

- Building security | Ensuring safety and security of common areas.

- Gardener and green maintenance | Possibility of using the garden or green space in front of the house.

Conversely, tenants cannot be required to pay for items that enhance the homeowner's property or serve to manage it. They are therefore linked to the ownership and do not benefit the tenant immediately.

In particular, tenants CANNOT be required to:

- Payments to the Repair Fund (long-term deposit) | They are used for property appreciation (reconstruction, etc.).

- Repayment of the SVJ / Cooperative Annuity loan | Payment of the owner's claims against the SVJ / Cooperative.

- Property insurance | Protection of the owner against possible risks.

- Management and accounting fees | Management of the property and allocation of its operating costs.

- Remuneration of statutory bodies | Remuneration for the activities of persons involved in the operation of the house.

A common problem is that the HOA or Co-operative Society inaccurately titles items in the accounts and this can unnecessarily create discrepancies and inconsistencies. Therefore, it is ideal to always attach the monthly payment schedule to the lease agreement and clarify in advance what will be overcharged to the tenant.

We often hear opinions that it is just an agreement between the tenant and the landlord about what will be overcharged. However, this is not true, as the tenant is protected by law as the weaker party, so clauses that may curtail their rights may be invalid. However, most tenants prefer to avoid conflict with the landlord and pay even those items they do not have to pay.

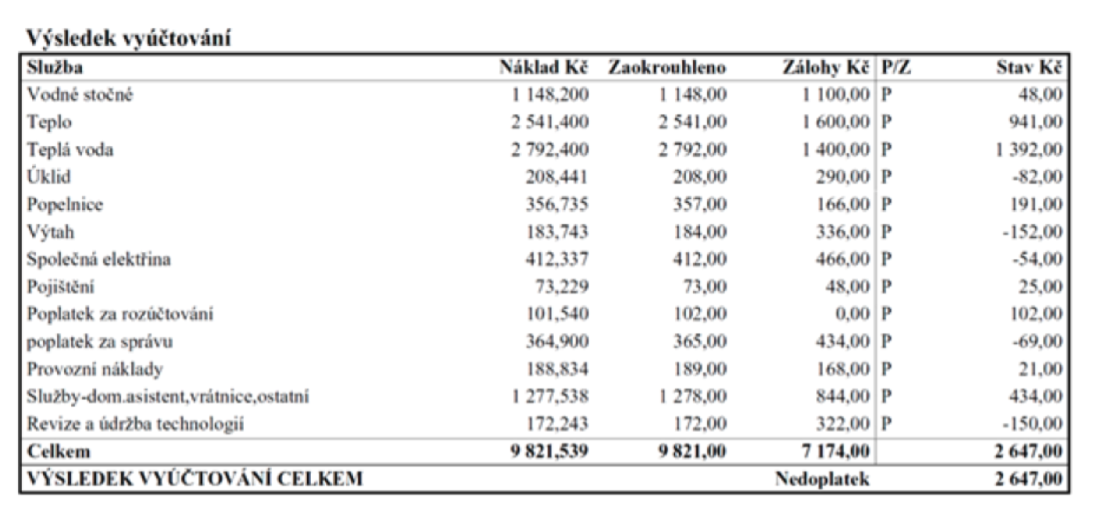

If tenants use the apartment for a full year, the billing is fairly straightforward. It is simply a comparison of the sum of the deposits paid for the whole year and the actual annual costs of utilities and services, which can be recharged to the tenants as part of the annual bill. The result is either an OVERPAYMENT (deposits are higher than actual costs) that we refund to tenants or a NON-OVERPAYMENT (deposits are lower than actual costs) that we have tenants pay.

What if the tenants only used the apartment for part of the year?

If you only need to bill for part of the year, this complicates the situation considerably and you need to look at the individual items on the annual bill and determine whether these are measurable values based on the meters (calorimeter, water meter, electricity meter, gas meter) or whether we will use coefficients to bill.

For costs that cannot be measured (common electricity, house lighting, lift, reception, etc.), we will determine the coefficient by the ratio of the number of months the tenant has used the property to the total number of months in the year (12). If the tenant used the apartment for example from January to March (3 months) the coefficient is 3/12, i.e. 25%.

The above procedure cannot be applied only for heat billing, where it is necessary to take into account the energy intensity of individual months, which can be found in Annex 1 of Decree No. 269/2015 Coll.

Month %

January 19

February 16

March 14

April 9

May 2

June 0

July 0

August 0

September 1

October 8

November 14

December 17

So if we consider the same case as above and the tenant will use the apartment from January to March (3 months) the conversion factor will be 19+16+14 = 49%.

Cooling of the real estate market

You've probably heard the news that the real estate market is gradually cooling. There are many reasons. That's why we will show you the main ones here

More